Solutions

for brokers and intermediaries

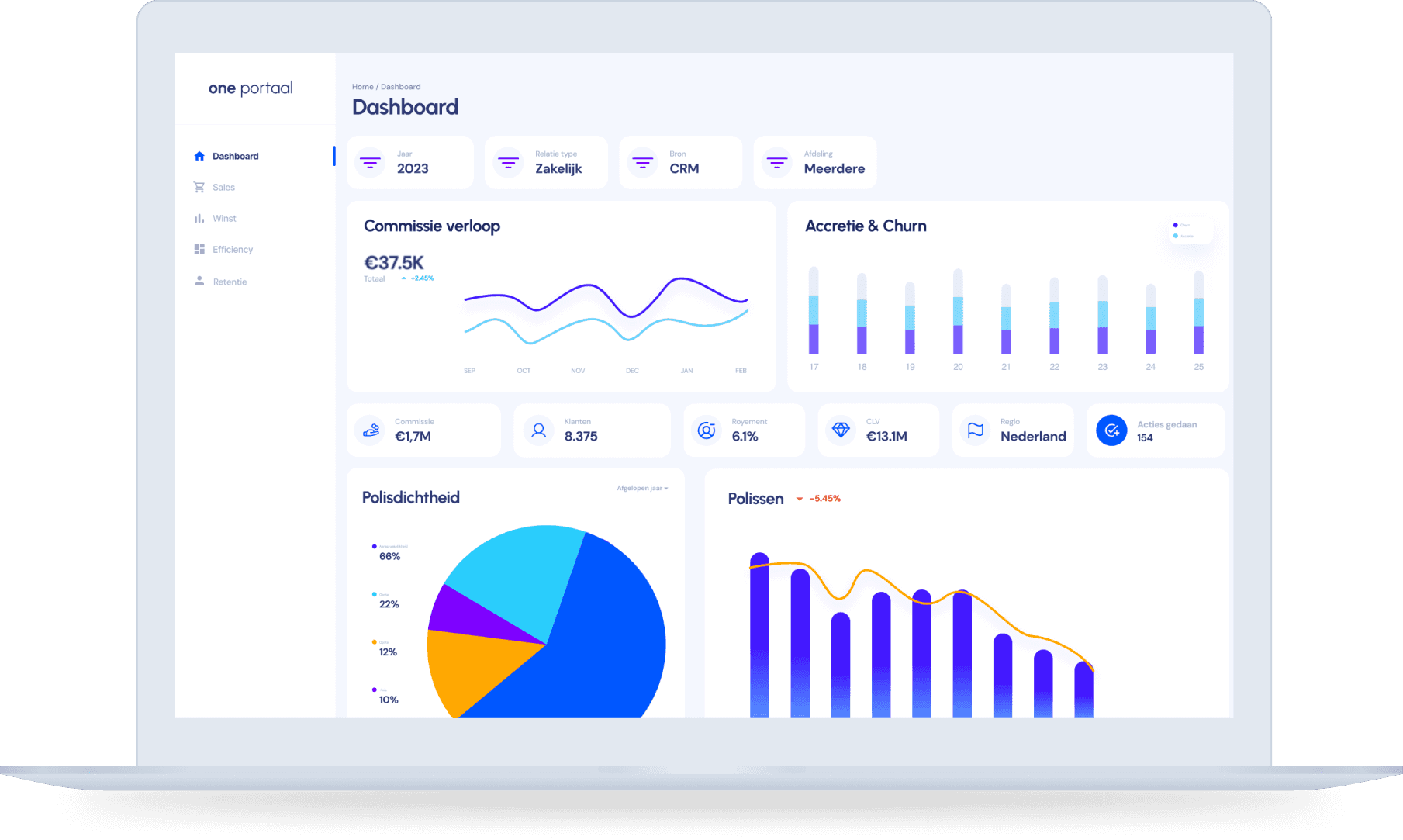

With AI-powered active client management, you can make the most of your advisors' limited time while also ensuring a better client experience. We'll show you how this translates into measurable results: higher commission revenue, less churn, and increased profits.

What goals does

your organization have?

Our modules are tailored to the challenges in the insurance market. Depending on your strategy, there are different product modules that can be used separately, or combined, to take your business to the next level.

An intuitive interface

for the advisor